A mortgage broker is there to help and advise you through the process of applying for a mortgage, helping you to find the best deal possible. Buying or re-mortgaging a home can be a stressful time, there are many different things to take into consideration. A mortgage broker is there to help you through the process providing you with advice and support to relieve your stress. The market for mortgages has become more competitive, therefore mortgage brokers have become more sought after.

Benefits of using a mortgage broker

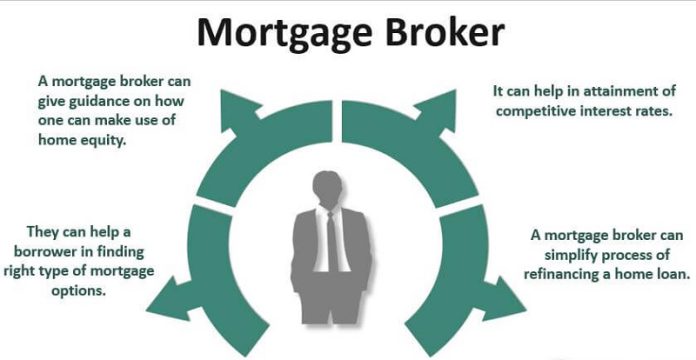

A mortgage broker can benefit you in different ways, helping to make the whole process simpler, smoother and less stressful.

- Secure a better deal for you making it financially beneficial

- Access to more products and services

- Expert advice

- Help with paperwork and the application process

- Saves you time

- More likely to be accepted for a mortgage

When to see a mortgage broker

You should see a mortgage broker when you need access to loans that you may not meet all the requirements for. Things like not having a good credit score, or maybe being unable to find a loan suitable to you is when a mortgage broker would come in handy. Although some people still use mortgage brokers regardless of their situation, to help guide them through the process as they can help secure you lower interest rates, and give their expert advice.

How much does a mortgage broker cost

A lot of mortgage brokers get paid on a commissions basis, they get paid by the lender, it is dependent on the amount of mortgages they complete for their customers. Some are paid on a salary plus commission, and some are just self employed. A mortgage broker can also charge a fee for their services, they usually would charge a fixed fee or take a percentage of the loan amount, you will be made of your mortgage broker fees during your appointment. Each mortgage broker will charge a different fee.

Choosing the right mortgage broker

You want to choose a mortgage broker who is fully qualified, preferably with years of experience. Suttons IFA has 20 years of experience in financial planning and wealth management, understanding that people want to work with an advisor you can trust. Going to a mortgage broker that is the whole of the market, and not just tied to certain providers needs to be considered when choosing the right broker. If they are the whole of the market you are more likely to have access to better deals. Have a little look around, read the reviews and consider who might be best for you.